Like Amazon and other online-based shops, which have experienced a significant decrease in revenue, Shopify stock has also fallen by 80% this year. There are multiple reasons that have contributed to this together, but the biggest one is the lifting of bans related to the pandemic. Once life had become normal again, and people were able to buy stuff in the actual stores, online shopping significantly decreased.

Table of Contents

What was going on with Shopify?

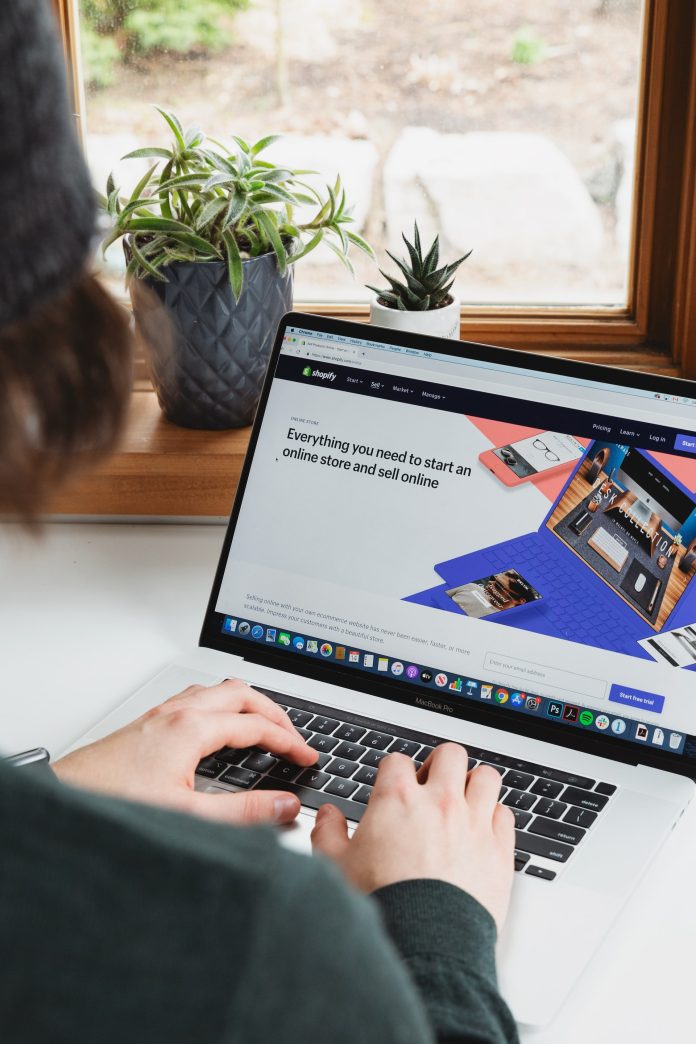

Shopify, an e-commerce platform that went public in 2015, was built and imagined to give a chance to small businesses to create their own online stores that can be fully customized. It is completely dedicated to the merchants, and this is precisely what differentiates Shopify from other online marketplaces, which put focus only on the customers.

Like most e-commerce platforms, Shopify had a great period during the pandemic of Covid-19 since everyone turned to online shopping. However, by marking a slight end of the pandemic this year, these exact e-commerce platforms experienced devastating declines when it came to profit, sales, or total revenue.

Last year, in the first three quarters, Shopify saw an increase in its profit to 750%. The main question was if Shopify would be able to reach the same results in 2022, but there was no chance of that.

This brilliant increase in profit from 2021 has turned into a huge decrease in 2022. The reasons for this misfortune include various factors, such as inflation and constantly rising interest rates, a global crisis, political tensions, and disruptions within the supply chain.

What else influenced the lower revenue of Shopify?

Shopify’s earnings from the second quarter of 2022 were quite disappointing. The total revenue has grown only 16%, in contrast to the 57% growth that was reported in 2021. Comparing pandemic period revenue with the income from normal times is pretty absurd since the total situation is different.

However, Shopify made an extremely big mistake by predicting the same success in 2022 and unnecessarily overexpanded itself. For example, they invested much more money in marketing activities to reach a bigger number of audiences.

Furthermore, research and development got a bigger budget within Shopify. Also, Shopify hired more staff, which was basically not needed. Of course, the expected growth never become materialized, so the total operating income from a gain of $139.4 million dropped to a loss of $190.2 million in 2022.

As Shopify was growing and becoming a serious competition to multi-billion-dollar companies like Amazon, they invented new ways to draw attention from consumers and merchants. For example, Fulfillment by Amazon and Buy with Prime are great alternatives to Shopify and are hard to compete with due to their much bigger budget.

This was probably the reason why Shopify has invested $2.1 billion to buy a logistics platform named Deliverr, which could significantly increase its capacity and fulfillment speed.

Conclusion

As you can see, not only the world crisis and the end of the pandemic had an influence on the smaller revenue of Shopify and the fall of its stock. Overestimating the company, predicting the wrong things, and trying to compete with the “big fish” were probably some of the most diminishing factors.